By David Gold

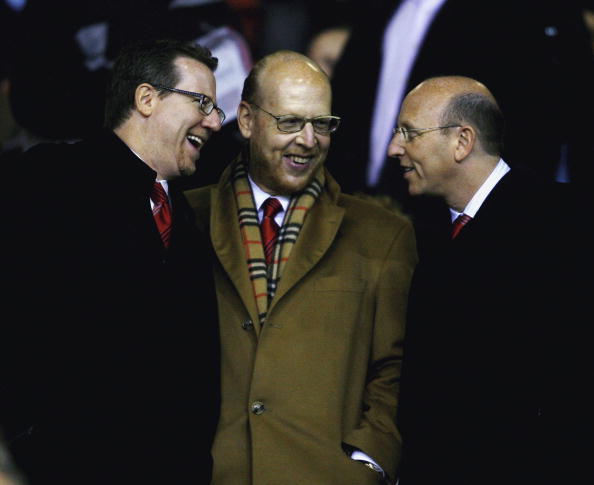

September 1 – Manchester United has announced profits of £29.7 million ($48 million/€34 million) as the English outfit’s owners, the Glazer family (pictured), prepare to partially float the club on the Singapore Stock Exchange in an attempt to reduce their £308 million ($499 million/€349 million) debts.

Revenues rose to a record £331.3 million ($537 million/€376 million) in the year, which ended June 2011, representing an increase of 16 per cent on last year’s £286.4 million ($464 million/€325 million).

The Glazers announced plans to float approximately 25 per cent of the club’s shares on the Singapore Stock Exchange last month, a move that received a cautious welcome from their supporters, though questions were raised about their decision to float there.

United’s success has been underpinned by continued success on and off the pitch, as Sir Alex Ferguson’s side swept to a 19th Premier League title last season, setting a new record, whilst also reaching the final of the European Champions League.

Though they lost in that game to Barcelona 3-1 at Wembley, they made more money from the competition than any other side.

United also announced a £40 million ($65 million/€45 million) deal with DHL last month to sponsor the club’s training kits in an agreement, which also sees the delivery giant’s name appear on advertising boards at Old Trafford.

However, the debts that the Glazer family placed on the club when they bought it in 2005, which are located in a holding company, continue to hold United back, as £51.2 million ($82.7 million/€58 million) was paid in interest over the year.

That figure represents just over half of the operating profits registered by the football club, though the net debt is the lowest level it has been since the owners bought United.

The Manchester United Supporters Trust welcomed the news, but took a swipe at the club’s debt.

“While the financial results are strong, they also show that the Glazers have taken another £51 million out of the club in the last 12 months as well as using an even bigger chunk [£64 million] of the club’s money to pay down part of their bond debt,” said a spokesperson for the Trust,” the said.

“This is money that the club has generated and money that should stay in the club rather than go to Florida or to pay down the Glazers’ debt and interest.”

Overall, commercial revenues were up 27 per cent, which does not include the DHL deal, while media income also rose substantially.

Although wage costs have increased, United’s wages to revenue ratio is far healthier than some of their main rivals, particularly Chelsea and Manchester City, and unlike those two sides, United should have no problems meeting the new UEFA financial fair play regulations.

Those rules require clubs to balance their books each year and allow for no more than £40 million ($65 million/€45 million) of losses over the first three years that are scrutinised.

As the debt is in the holding company, and the club itself is extremely profitable, this would appear to be no problem for United.

The news will be a huge boost with the club looking to reassure potential investors ahead of the Singapore flotation.

Contact the writer of this story at zib.l1741620562labto1741620562ofdlr1741620562owedi1741620562sni@d1741620562log.d1741620562ivad1741620562

Related stories

August 2011: David Gold – Will United sink or swim in partial flotation?

August 2011: Manchester United to float on Singapore stock exchange

July 2011: Manchester United tops world football rich list

June 2011: Manchester United owners eye £1.7 billion Hong Kong float

March 2011: Manchester United make multi-million pound loss