By David Owen

March 8 – The 2013-14 season is set to go down as a major milestone in the business annals of the Premier League, with the 20 clubs on course to record an aggregate pre-tax profit – perhaps a substantial one – for the first time in over a decade.

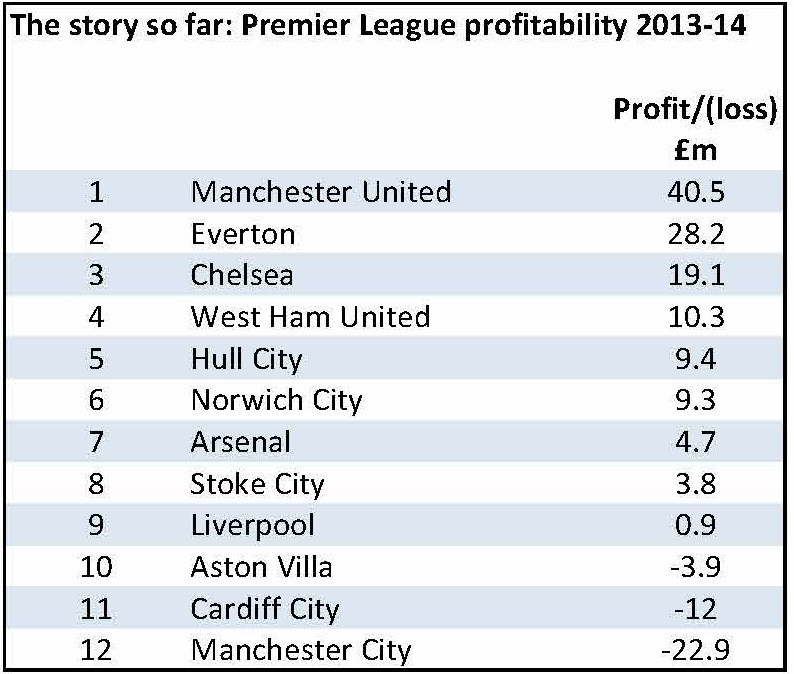

With results in from 12 of the 20 teams, including all the really big boys, combined profits are running at close to £90 million, with only three clubs – Aston Villa, relegated Cardiff City and Manchester City – in the red.

Of the eight still to report, Tottenham Hotspur’s figures should benefit enormously from Gareth Bale’s lucrative September 2013 transfer to Real Madrid, while Swansea City and Newcastle United clocked up the best pre-tax profits in the league in 2012-13. The Magpies will, moreover, have the January 2014 transfer of Yohan Cabaye to Paris Saint-Germain to include this time around.

I would be surprised if Southampton and West Bromwich Albion did not further swell the aggregate profits total, while Crystal Palace even managed to turn a profit in their promotion year of 2012-13. That leaves just Sunderland and Fulham.

All in all, I would not be surprised to see a combined profits total pushing up towards the £200 million mark – an astonishing (and astonishingly fast) turnaround from the £316 million aggregate losses run up in 2012-13.

In that season, five Premier League clubs – Aston Villa, Chelsea, Liverpool, Manchester City and Queens Park Rangers – each made losses in excess of £50 million ie £1 million a week.

One year later, QPR were back in the tier-two Championship, while aggregate losses at the remaining quartet had been pared drastically to less than £7 million.

Two factors appear to be behind the near miraculous pendulum swing: substantially higher broadcast income for everyone as a result of the new set of Premier League TV deals; and the fall-out from UEFA’s Financial Fair Play (FFP) initiative.

The pressure on clubs to get their bottom-lines in order appears for now to have undermined players’ bargaining power sufficiently to prevent the extra TV income draining away into pay packets, as has happened in the past. At the same time, the ability of clubs to amortise transfer fees over the length of acquisitions’ new contracts helped to ensure that FFP did not have a similarly depressing effect on the transfer market.

With another huge jump in broadcast revenue already in the pipeline and most clubs now on an even keel or better financially, it will be interesting to see whether players and their representatives are able to restore their leverage and pocket a higher share of the increased future income we know is on the way.

It also seems logical to expect this profits explosion to spark a re-rating of Premier League club valuations – if, that is, investors think the new landscape is sustainable.

Figures from professional services firm Deloitte show that clubs have run up aggregate pre-tax losses every year since at least 2003-04. The biggest such annual loss was £406 million (£20 million a club) in 2009-10 and the aggregate over the decade to 2012-13 was well over £2.5 billion.

Contact the writer of this story at moc.l1741596286labto1741596286ofdlr1741596286owedi1741596286sni@n1741596286ewo.d1741596286ivad1741596286