By Paul Nicholson

November 25 – The revenue gap between Europe’s big five leagues and the rest is getting bigger and within those leagues the big five teams in each league are getting even bigger at the expense of their domestic rivals. Manchester United, with commercial income of about €226 million, generate or receive a massive 21% of the Premier League’s total.

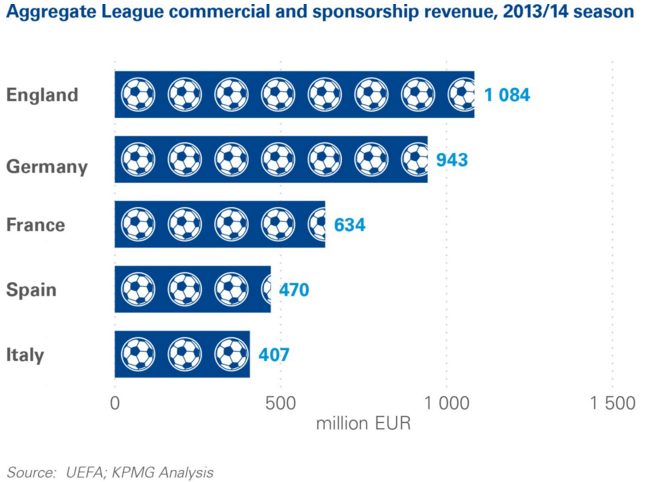

The analysis, done by KPMG Sport Practice’s Football Benchmark research arm, found that England, France, Germany, Italy and Spain make up a whopping 67% of Europe-wide commercial revenue,. And England and Germany combined represent 57% of the total aggregated amount for these leagues and almost 40% of the overall European commercial and sponsorship income.

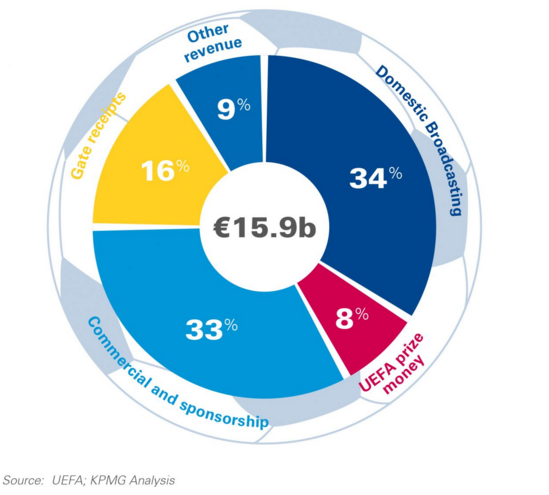

Football Benchmark puts the revenue figure for European club football at an annual total of €5.3 billion with sponsorship and broadcasting streams being the fastest growing, having lept up by 45% over the past five years.

Aggregate revenue streams for European football clubs: 2013/14 season

The concentration of these booming revenues into the top five teams in the top five leagues is stark, and does not look to lessening. In contrast the poor only look set to get poorer.

In England’s Premier League, for example, Manchester United, Manchester City, Chelsea, Liverpool and Arsenal account for over 50% of the total for the league. Each club generates commercial and sponsorship income of more than €100 million.

In Spain’s La Liga the polarisation of revenue is even greater with Barcelona and Real Madrid accounting for 90% of La Liga’s total commercial and sponsorship income, though the new collective rights and revenue distribution agreements within the league should see that figure drop as the Spanish drive harder into international broadcast and sponsorship markets.

In Germany Bayern Munich dominate with €292 million in 2014 – about a third of the total commercial revenue of Bundesliga I. Since 2009, the club’s commercial income has gone up by 83%.

France is dominated by Paris St Germain who with €328 million in 2013/14, accounted for more than half of total French Ligue 1 commercial and sponsorship income.

Italy, reflecting Serie A’s decline in popularity worldwide is very much at the bottom of the ‘big five’ in terms of commercial and sponsorship income, with an aggregate €407 million in the 2013/14 season.

Outside the ‘big five’ leagues only Russia and the Netherlands generate more than €100 million with the remaining 47 European leagues registering a combined commercial income of approximately €1 billion.

The Russian Premier League is the stand out league that challenges the Western European dominance with €537 million in 2013/14, higher than both Spain and Italy. But with the Russian economy having nosedived and a number of significant football investors having scaled back it is unlikely to have sustained that economic challenge.

The Football Benchmark report concludes that the market is only going to get tougher for the smaller clubs from the smaller leagues and national economies. “It is difficult to foresee second tier leagues being able to break into the upper echelons of commercial income generation,” says the report.

To view the analysis go to https://www.footballbenchmark.com/commercial_income_in_europe

Contact the writer of this story at moc.l1751313819labto1751313819ofdlr1751313819owedi1751313819sni@n1751313819osloh1751313819cin.l1751313819uap1751313819