By Paul Nicholson

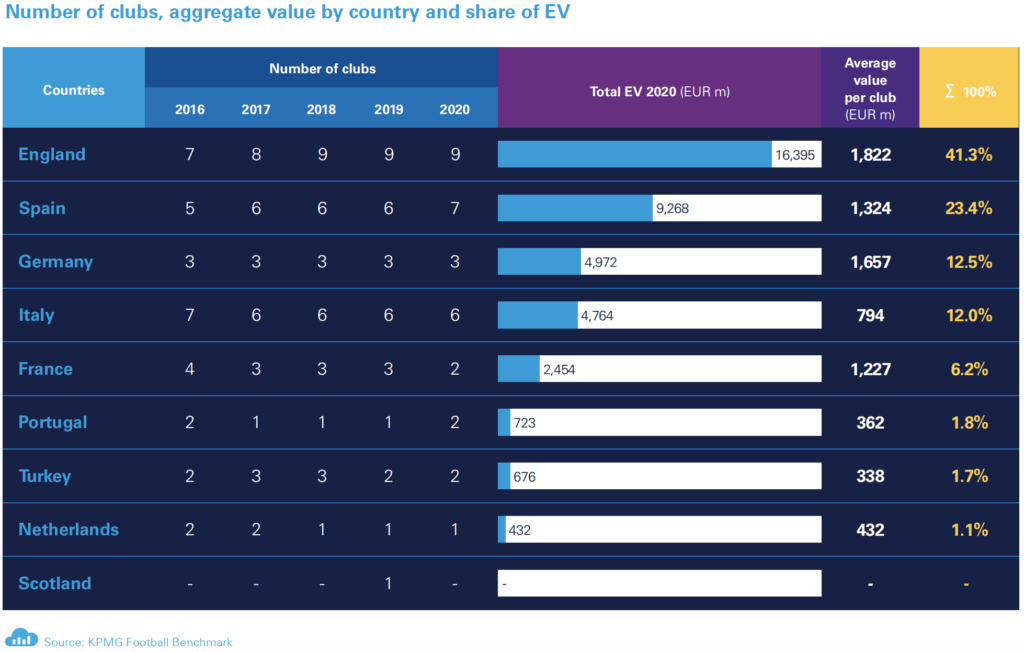

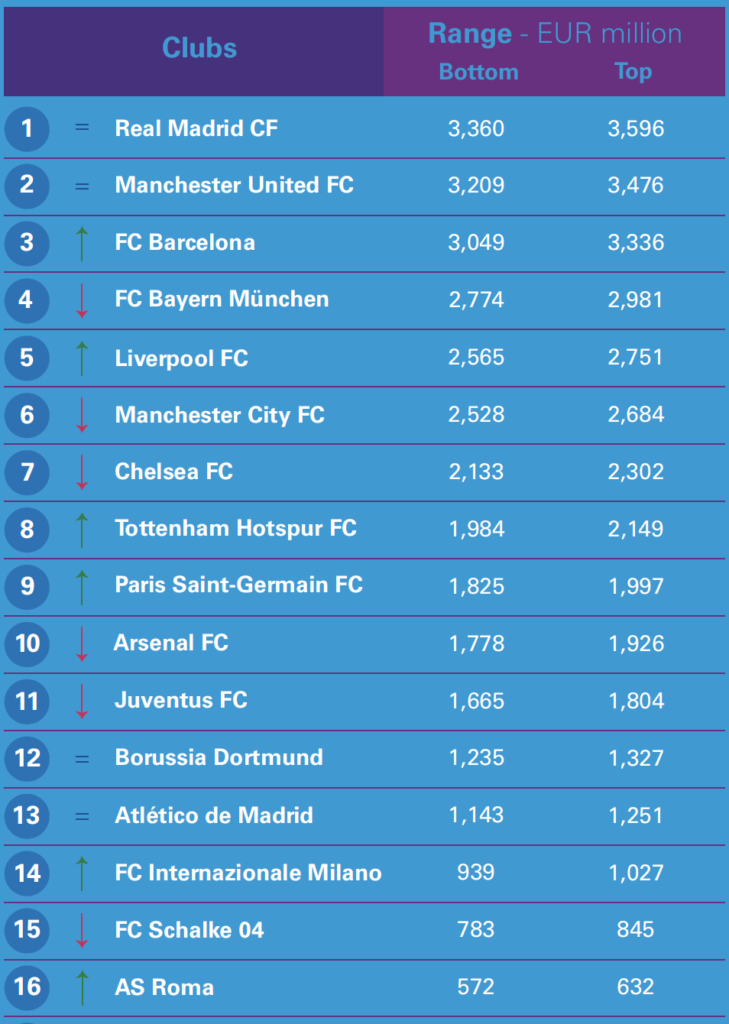

May 28 – Real Madrid are still the most valuable club in the world, ahead of Manchester United, Barcelona and Bayern Munich, according to latest figures in the KPMG Football Benchmark 2020 club evaluation report that looks at the 50 elite clubs in European leagues.

The figures are calculated from data up to five months ago, so do not take into account the affect of the coronavirus pandemic.

While KPMG head of global sports Andrea Sartori acknowledged that the pandemic will have undoubtedly affected club values, “ the immediate impact cannot yet be quantified. While we have witnessed a significant drop in share prices of football clubs listed on various stock exchanges since the outbreak of the crisis, there has been a slight recovery recently with the hope of a restart of the current season in most countries.”

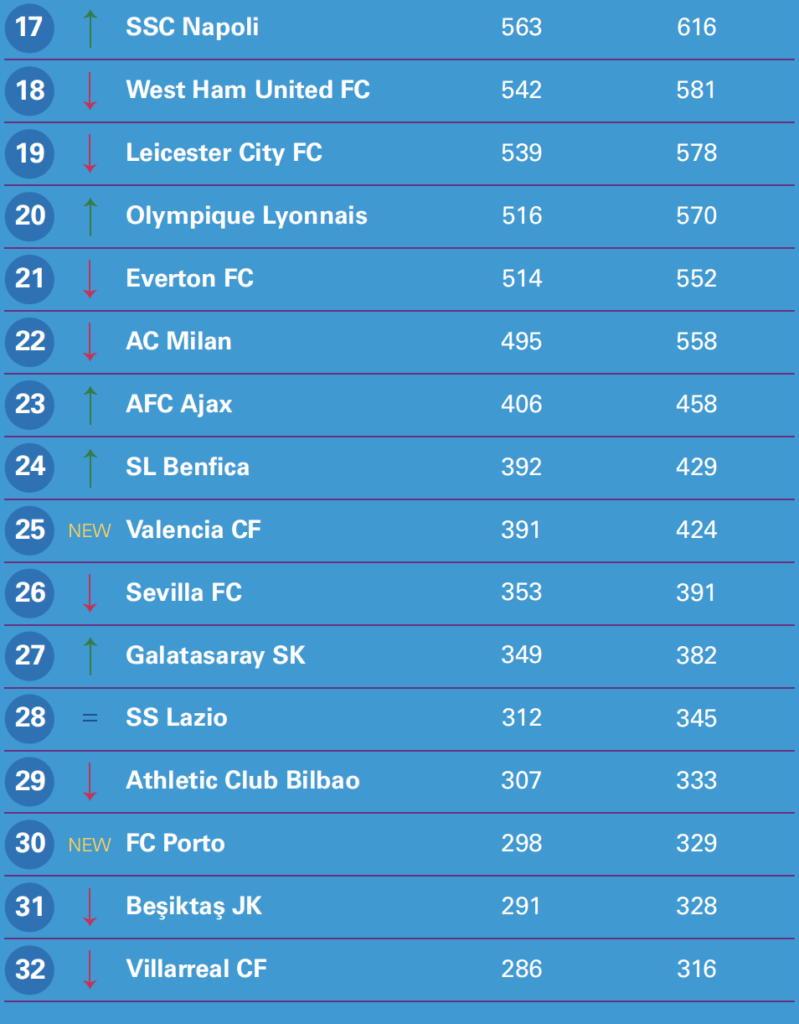

KPMG uses its own formulas to analyse what it calls club enterprise values (EV). While the top of the ranking of clubs remains relatively unchanged, there are some notable changes. Barca leapfrogged Bayern to return to third spot while Liverpool move up two places to fifth and PSG similarly moved up two places to get into the top 10 for the first time at ninth.

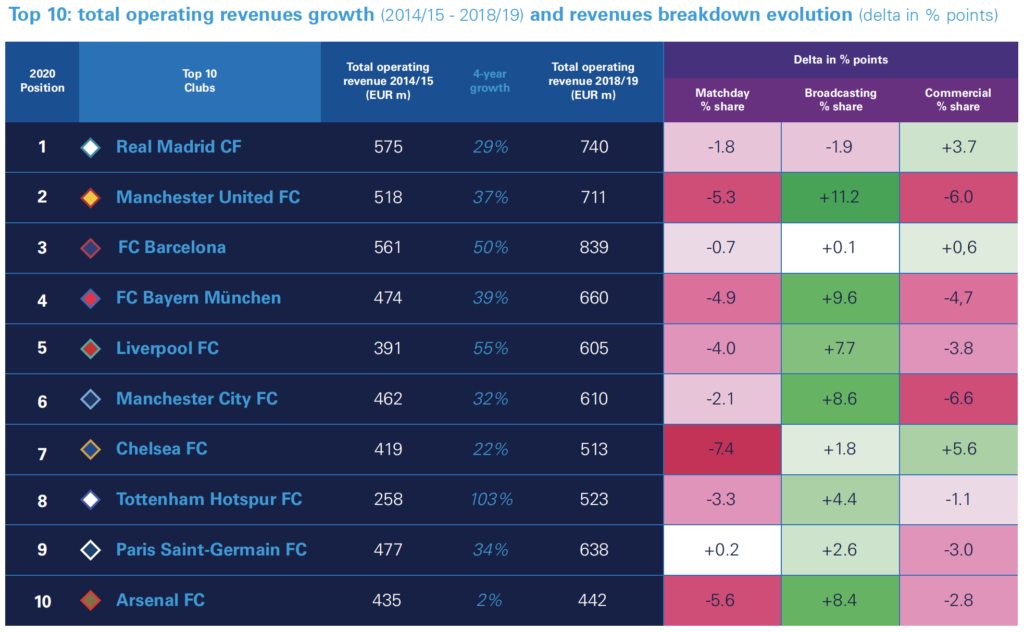

Arsenal continued their relative demise dropping two places to 10th and notably below their north London rivals Tottenham Hotspur who move into 8th spot and have shown a 103% growth over the four year period, compared to Arsenal’s 2%.

With Juventus dropping down, for the first time there was no Serie A club in the top 10. Where Juve do buck the trend is in social media numbers where the report points to a 4-year growth of 289% in total followers and the 4th spot in terms of total social media followers among the top 32 clubs.

“Over the five years of our analysis, Real Madrid CF managed to retain their leadership primarily due to the rewards of their three UEFA Champions League trophies in a row, and a 41% aggregate growth in commercial revenue. After three years on top, Manchester United FC stayed up on the podium thanks to the brand’s appeal and an impressive cumulative EBIT of €338 million. FC Barcelona’s 5-year trend reveals a 50% growth in total operating revenues, while commercial activities became their most successful revenue stream, resulting in 52% growth from 2016,” said Sartori.

While Spurs (158%) have had an impressive rise in enterprise value, they are still second to the meteoric increase of Olympique Lyonnais who have seen their EV grow 193% in five years. In comparison Liverpool have risen 109% while Man Utd are one of the bottom performers in this regard, rising just 15% over the five-year period.

The elephant in the room for this report is always going to be the affect of the pandemic, however, as Sartori points out, it will provide “a crucial benchmark to compare values and trends in our next yearly report, and thus see the true impact of the pandemic.”

The report does point to previous research from KPMG assessing the effect of the crisis on players’ market values. That research found that the aggregate value of the 4,180 players in the 10 European leagues analysed, decreased by a total of almost €10 billion, a 26.5% drop since February in case of cancellation of the 2019/2020 season. They also calculated players’ values would drop by a lesser €6.6 billion, (17.7%), in the alternative scenario of leagues completing the current season behind closed doors.

However, the reality is that it is too early to assess full economic impact on club values of the pandemic. In part to address this, the report features opinion from a number of football industry leaders that cover their expectations of what the future could look like.

“All contributors to our report have underlined the importance of ensuring that football

stakeholders, in response to the COVID-19 crisis, grasp the opportunity to create a more balanced, financially sustainable and competitive football ecosystem, with a focus on common goals and mutual long-term benefits, rather than short-term individual objectives. This for the benefit of rights holders, clubs, players, media and sponsors involved in the industry, but, above all, this should be done for the millions of fans and supporters of the “beautiful game” globally.

Source: All tables KPMG Football Benchmark

Click here to access the full report.

Contact the writer of this story at moc.l1745254876labto1745254876ofdlr1745254876owedi1745254876sni@n1745254876osloh1745254876cin.l1745254876uap1745254876