By Paul Nicholson

November 19 – Private equity money looking to make a play in the football business is not being discouraged by the pandemic with investors increasingly looking at opportunities outside the higher priced top tiers of the Big 5 league clubs.

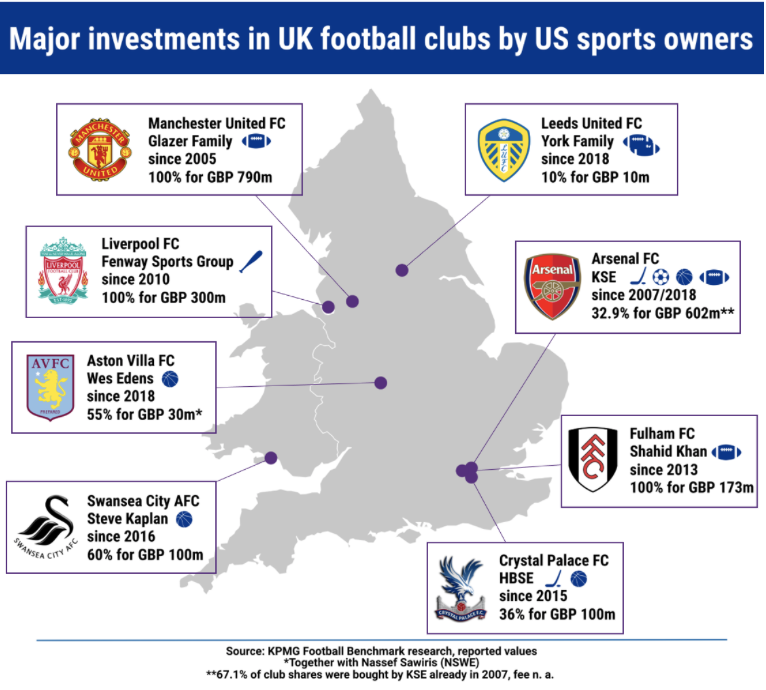

US investors have been increasingly active and a report by the KPMG Football Benchmark team highlights them as “well-poised to penetrate the European market”.

“Investors have begun focusing their attention on secondary targets, ranging from lower-division clubs with a potential of promotion to the most lucrative domestic leagues or clubs in less privileged leagues but with the possibility to qualify for European competitions,” say KPMG.

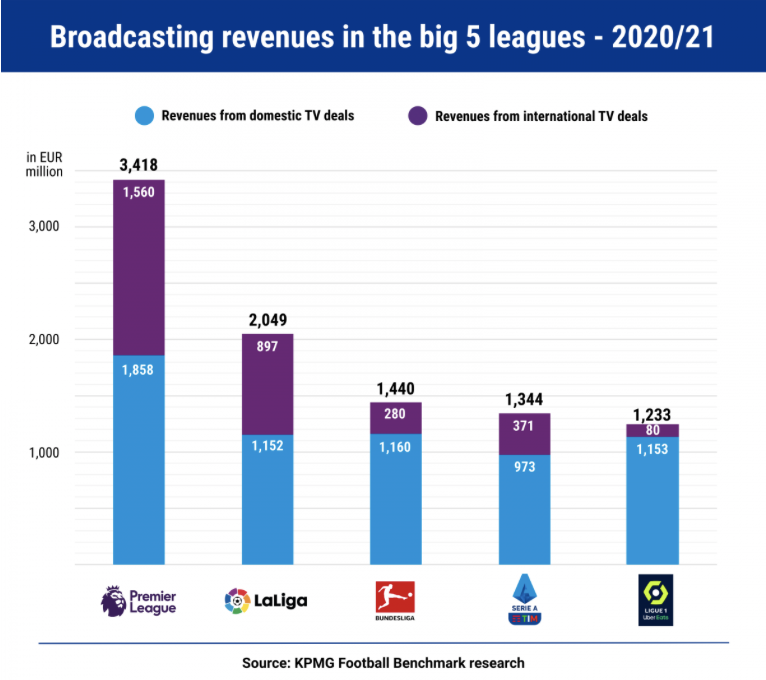

The interest in European football clubs has been driven by the digital transformation that has pushed professional football closer to becoming “a true entertainment industry”, says the report. The entertainment business is something the US does not need to learn and with the European football market showing a 68% growth in operating revenues from €13 billion in 2010 to €21 billion in 2018 in operating revenues, it looks an increasingly attractive stage to play on.

The big five European football leagues and their clubs have until now been the most attractive opportunities for investors, but there has been a slowdown in ‘big’ deals with targets outside those leagues coming into focus. In some cases these clubs could provide the opportunity for potentially spectacular growth if they qualified for European competition.

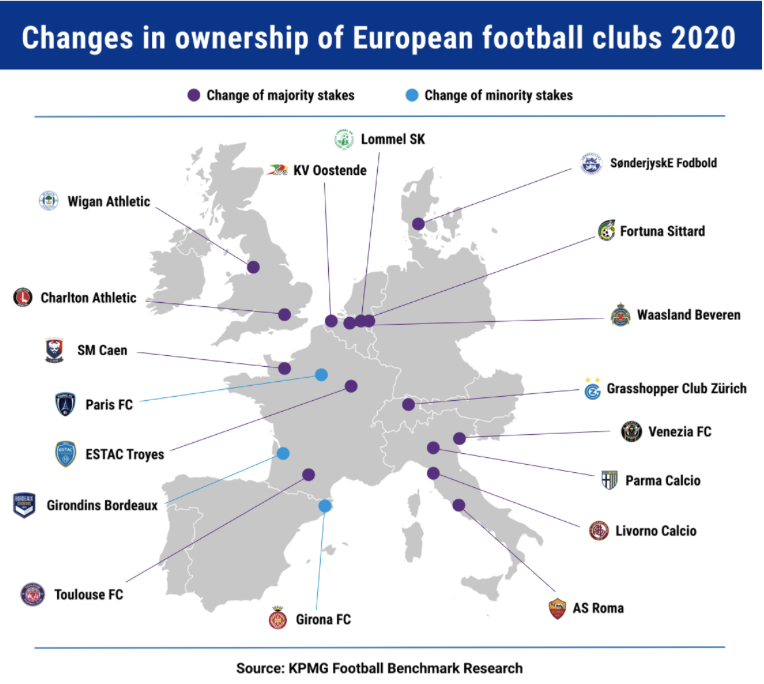

KPMG highlight that there were five deals in England’s two top divisions in 2019, while only two have been reported in 2020 so far. A 35% stake takeover of second-division club Girona FC has been the only transaction in Spain this year, in contrast to five deals completed there in 2019.

“France, however, has recorded five deals this year, most of them involving the takeover of minority stakes of lower tier clubs, while in Italy, AS Roma, Parma Calcio and Venezia FC all changed majority owners despite the uncertainty caused by the coronavirus pandemic,” says the report.

There have been less than 20 major deals completed in 2020 which compares to 20 in 2018, but lower that the 45 in 2019. Despite the lower figure, the feeling is that the appetite for deals hasn’t change, if anything it has increased as investors hunt for what will be the best post-pandemic opportunities.

“Football clubs’ costs increased relative to their revenues during the pandemic as all of their income streams have been severely affected by the absence of gate receipts for most of the season and by some media and commercial deals having also been disputed by media partners and sponsors. Consequently, many clubs suffered a significant drop in their market value, making them a potential investment target,” said Andrea Sartori, KPMG’s Global Head of Sports.

“Besides the opportunity to buy a club at a lower price, investors could be attracted by the chance to acquire players at a discount in the coming transfer windows as some clubs may be forced to sell players in order to shore up finances.”

More significance is the source of new money. The retraction of Chinese investors from the European football market has been replaced by US investment firms who KPMG says are “perfectly poised” with the resources to act quickly and capitalize on such an opportune moment.

American investors “hold major stakes in approximately one-fifth of the 60 teams playing in the top division of England, Italy and France,” point out KPMG. “They remained active in 2020, too, acquiring controlling stakes in four clubs in these countries, including Italian outfits Parma Calcio and second-division club Venezia FC, as well as French second-tier side Toulouse FC. Still, the most notable transaction was the Friedkin Group’s purchase of 86.6% of Serie A giants AS Roma.

“The case of the Giallorossi is emblematic of the unique current market circumstances, as they changed hands at a lower price tag than the one reportedly originally agreed-upon right before the breakout of the pandemic.” Americans love a deal.

Shawn Quill, National Sports Industry Leader at KPMG in the US, insists American investors are looking at European football as a market with long-term profit-generating opportunities.

“Besides having solid financial background, US investors have extensive experience in the business of sports, and they possess the strategy and know-how to make the most of owning football entities. They view these investments as an opportunity to both diversify their sports ownership portfolio and to cross-promote the franchises under their ownership umbrella in a new market,” he said.

See the full report at https://footballbenchmark.com/library/pandemic_not_discouraging_football_club_investors

Contact the writer of this story at moc.l1745489961labto1745489961ofdlr1745489961owedi1745489961sni@n1745489961osloh1745489961cin.l1745489961uap1745489961