By Paul Nicholson

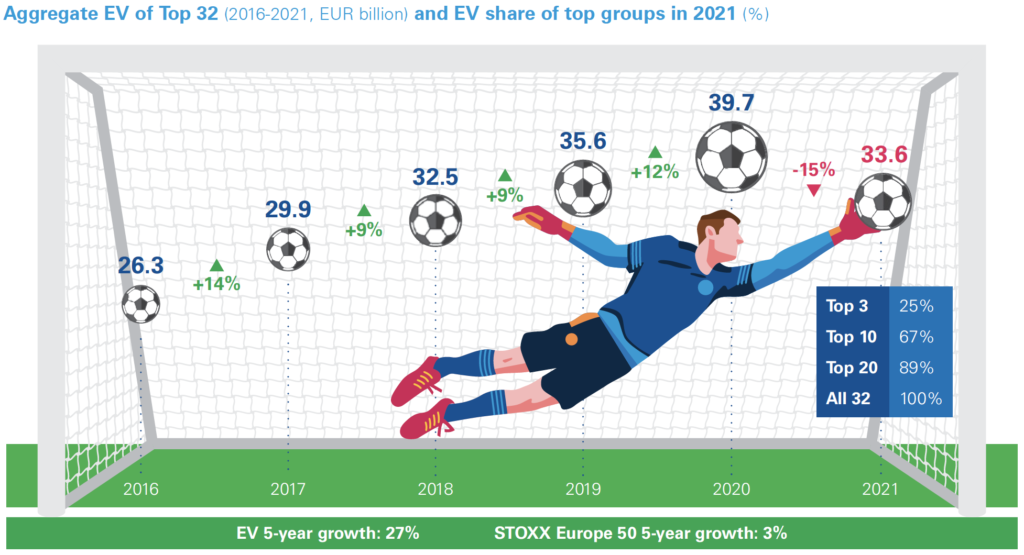

May 27 – The pandemic has knocked €6.1 billion off the value of Europe’s leading 32 clubs, according to the latest annual football club valuation report from the KPMG Football Benchmark team.

It is the first time in the six years of the report that the aggregate values of the top 32 clubs has decreased, from €33.6 billion to €27.5 billion, a drop of 15%.

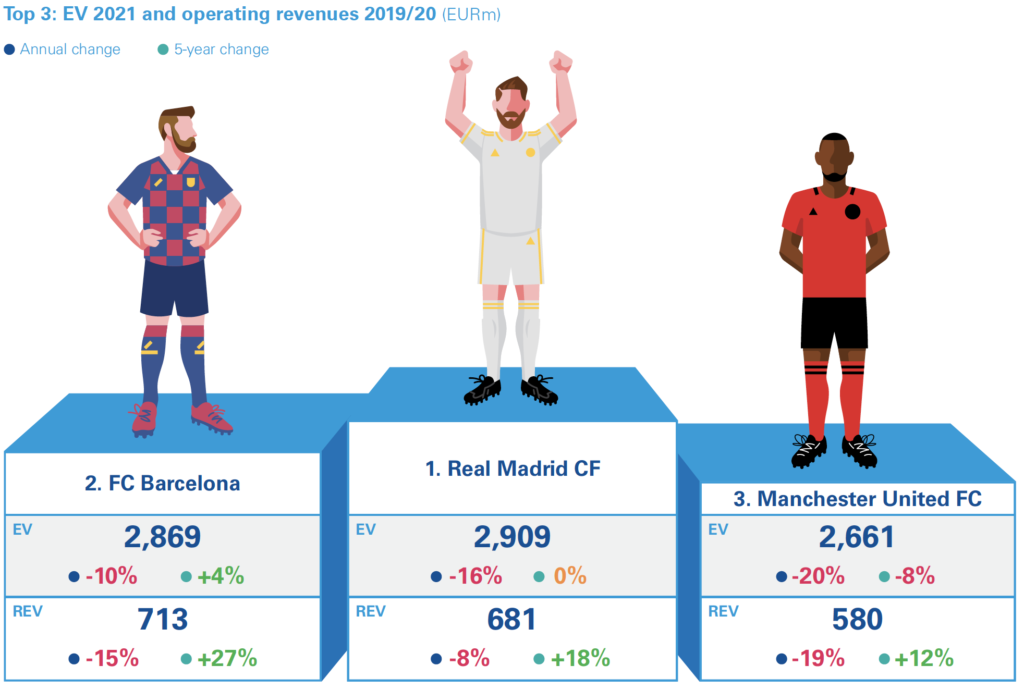

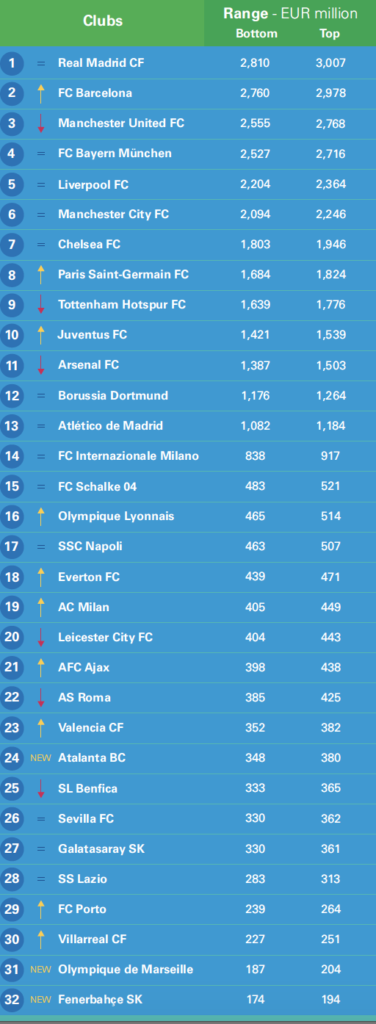

At the top of the valuation ranking (KPMG uses its own algorthyms to create what they call an ‘enterprise value) are Real Madrid, who were top for the third successive year. They are followed by Barcelona who leapfrogged Manchester United to take second position. Five of the top 10 clubs are from the English Premier League who have eight teams in the top 20.

Paris Saint-Germain moved up to the 8thposition, overtaking Tottenham Hotspur, while Juventus returned to the top 10, replacing Arsenal, who have lost six positions since the first, 2016 edition of our ranking.

Atalanta, Marseille and Fenerbahçe are new to the top 32, while West Ham United, Athletic Club Bilbao and Beşiktaş have dropped out.

Perhaps most concerning for the health of the financial health of the big clubs is that only seven of the top 32 clubs reported a net profit, compared to 20 profitable clubs a year before, reports KPMG.

KPMG also highlights the increasing divergence in values between the clubs in the top 10 compared to the other 22 clubs valued and pointing out that in “the past season the top 10 clubs’ operating revenues accounted for almost 60% of the total income of all 32 clubs, while they accounted for only a third of the aggregate net loss.” The might not be getting bigger, but they are still of a dominating size, and that isn’t changing.

“In each of the six years under scrutiny, the top 10 clubs have performed better than the other 22 clubs combined when considering total operating revenues, staff costs-to-revenue ratio and net result,” says the report.

In the report KPMG looks at the wide-scale impacts of the virus, estimating that the top division clubs of all 55 UEFA Member Associations combined will suffer an annual 11% drop in their aggregate operating revenues (-€2.5-2.7bn) in the 2019/20 season, down to levels recorded in the 2016/17 season.

KPMG also says that player values will be impacted with the aggregate market value of the 500 most valuable football players having decreased by 10% between February 2020 and April 2021.

“Eighty clubs including all European football giants, that have made public their financial results so far, recorded an aggregate net loss of €2.04 billion: this means that this sample of approximately 10% of the roughly 700 UEFA first division clubs have already racked up more losses in the 2019/20 season than the previous overall negative record of €1.7 billion in losses registered in 2010/11, prior to the introduction of UEFA Financial Fair Play,” says KPMG.

That is a fundamentally bleak prognosis for European club football.

Not all blame can be laid at the door of the Covid pandemic, with KPMG arguing that the global health crisis has only accentuated the underlying issues already present in football clubs’ business models.

In this respect they argue that reform is needed including the evaluation of what would be some fairly radical surgery on European league football including looking at reduction of leagues’ size, rationalisation of match calendars, the creation of regional leagues by merging smaller domestic leagues, “and last but not least, the redesign of FFP with a focus on more stringent cost control mechanisms”, said Andrea Sartori, KPMG’s Global Head of Sports and author of the report.

“For years, industry stakeholders have been focusing on their individual positions to protect the interests of their own organisations, without looking at the collateral effects of their expectations and ambitions on the overall industry. All parties need to realise and accept that football has gone through a vital transformation in recent years, mainly caused by the evolution of consumers’ habits and digitalisation, which, in turn, has led to the globalisation of the industry, benefitting mostly major clubs and leagues,” said Sartori.

“To ameliorate the state of European football, unprecedented flexibility, wisdom, responsibility and cooperation from all parties at all levels is needed. There is no other way to save the “beautiful game” and to make it sustainable for the benefit of all parties involved, above all for players and fans from all over the world, football’s most important participants.”

Contact the writer of this story at moc.l1745116502labto1745116502ofdlr1745116502owedi1745116502sni@n1745116502osloh1745116502cin.l1745116502uap1745116502