June 25 – The financial effect of the coronavirus pandemic on football has hit revenues and values, not least in the player transfer market, with the overall market value being predicted to drop 20-25%.

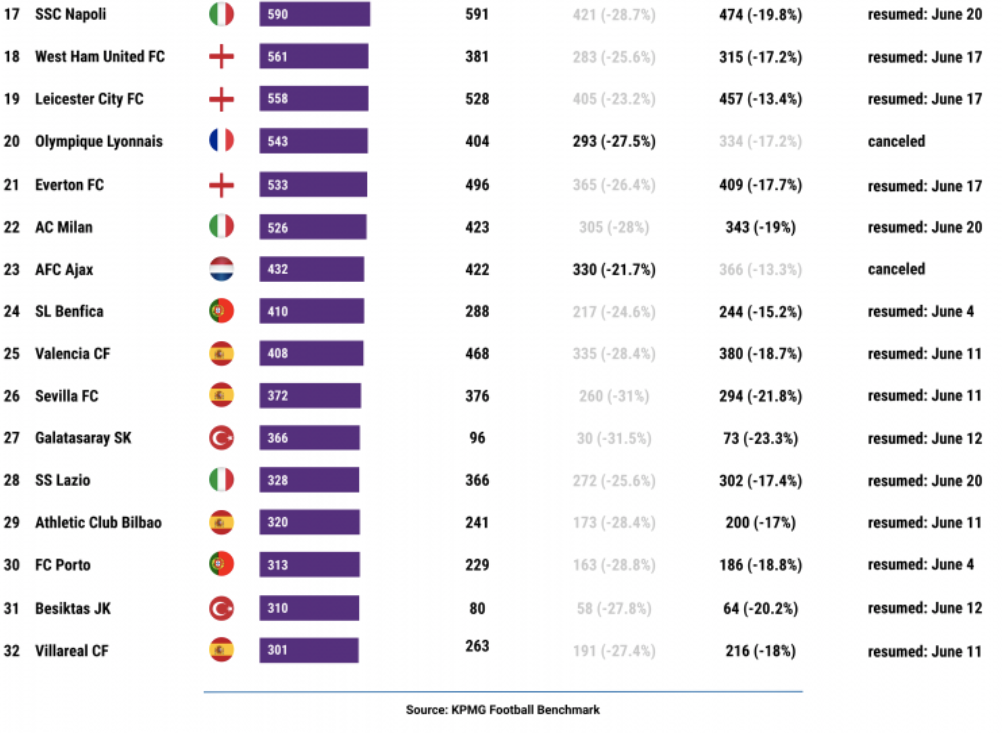

KPMG’s Football Benchmark have released a further piece of analysis looking at how the squad values of the 32 most valuable European football clubs have been affected by the pandemic.

The report is based on KPMG’s Enterprise Value database. Previous analysis “revealed that the aggregate value of all 4,183 players in the 10 European leagues under consideration decreased by a total of almost EUR 10 billion, a 26.5% drop since February for Scenario 1 (cancellation), whilst players’ values would decrease by EUR 6.6 billion, a 17.7% decrease in Scenario 2 (continuation and completion of the current season),” said KPMG.

Extending that analysis outwards and by club, the new report anticipates the top clubs can expect to lose between 10% and 30% of value with clubs in leagues that have not resumed being the hardest hit.

The French league which was one of the first to cancel sees PSG lose 24.5% of value and Olympique Lyonnais an even greater 27.5% of value, according to KPMB analysis. Ajax, who also failed to resume their season, lost more than 21% of value.

In contrast Real Madrid lost 19.1% of value while English commercial giants Manchester United lost a considerably lesser 13.8% of value.

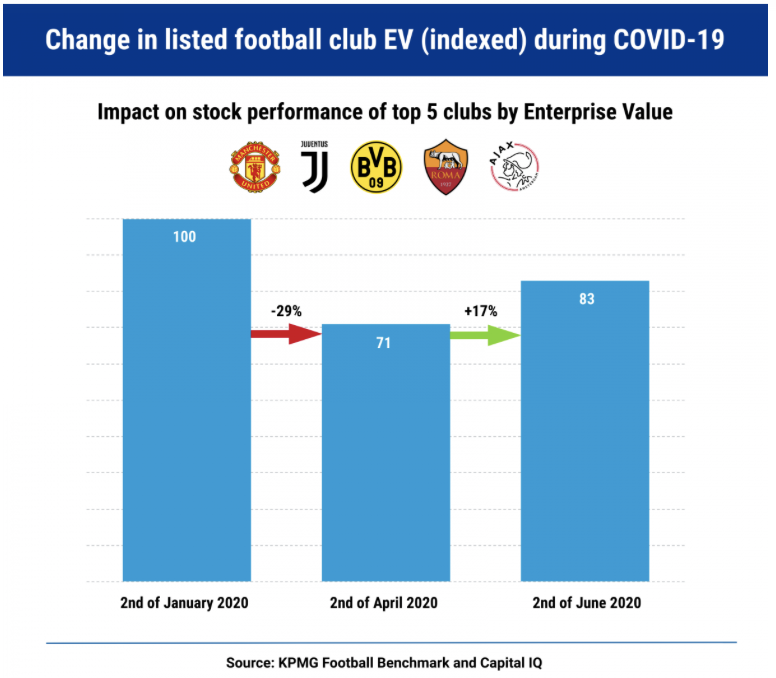

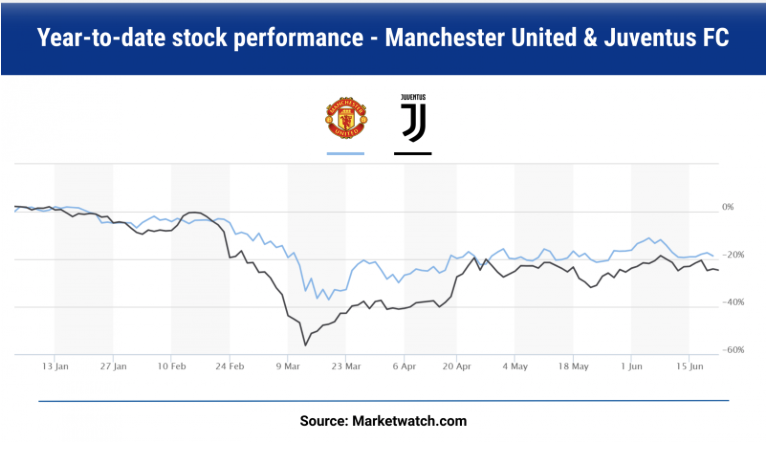

Looking at clubs quoted on stock markets, KPMG said: “While there has been a significant drop in football clubs’ share prices listed on various stock exchanges since the outbreak of the crisis, a recovery has been seen in the past several weeks, with the prospect of a restart of the 2019/2020 football season in most countries. We have observed a -29% drop in EV on markets (market cap plus net debt) for a selection of football clubs listed on various stock exchanges since the outbreak of the crisis (i.e. the first 3 months of 2020). However, there was an EV recovery in late May following the increased clarity from expressions of intent to complete the season, albeit behind closed doors.”

The overall conclusion is fairly obvious in that the pandemic will negatively affect football clubs’ valuations. What is more relevant is the range of devaluation between clubs, as pointed out by KPMG’ Global Head of Sports Andrea Sartori. This ultimately could affect their abilities to compete for the top players and hence their performance on the pitch and any commercial impact arising from that.

“Taking into account players’ devaluation and the performance of the largest listed clubs in recent months, KPMG’s forecast of the devaluation of the football sector at the top end of the market is between 20% and 25%, when compared with our recently published results of clubs’ EV as of 1 January 2020. Having said that, I believe peak devaluations for individual clubs can range from 15% up to 30%,” said Sartori.

“This depends on the strength of a particular club’s balance sheet, level of debt, structure of revenue mix and dependence on player trading activities. Obviously, each club’s situation and EV impact will need to be assessed individually upon availability of their 2019/2020 financial statements.”

See the full report at https://footballbenchmark.com/library/how_much_has_covid_19_degraded_the_value_of_europe_s_elite

Contact the writer of this story at moc.l1745224381labto1745224381ofdlr1745224381owedi1745224381sni@n1745224381osloh1745224381cin.l1745224381uap1745224381