November 4 – With the world in various stages of lockdown and fans in most countries unable to attend matches in stadia, the opportunity of engaging with fans via esports has not been lost on clubs or leagues.

A new report by the KPMG Football Benchmark team highlights esports as a long term growth opportunity and “a much bigger opportunity than just digital content in the form of football simulation games”.

The ability to engage with a new, younger audience, and to do so globally, is recognised as having core brand building potential. KPMG also emphasise that esports can turn into a long term revenue opportunity for clubs.

“Even before the pandemic had struck, football was facing an increased level of competition for attention, competing with streaming services, video games, OTT providers and other stakeholders in the entertainment industry. This extremely competitive field has mandated that clubs’ operations adapt to a more entertainment-focused business model, which is vastly different from how football clubs operate traditionally,” Andrea Sartori, KPMG’s Global Head of Sports.

“For top tier football clubs, esports is a relatable and somewhat similar industry, making it a logical first step in such a transformation.”

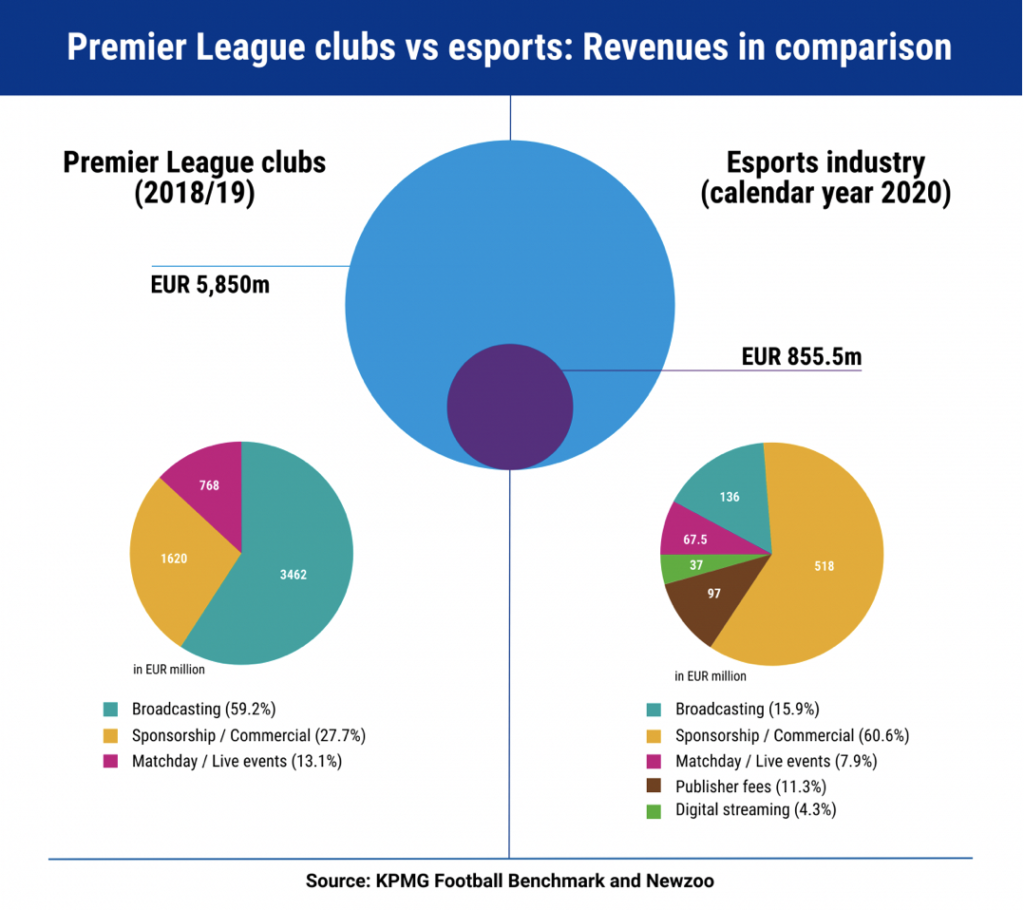

Esports industry revenues could reach $1.6 billion by 2023 while esports teams “could be the next in line for huge capital gains through market value increases, similar to those seen by football clubs in the last two decades,” says the report. “…an investment in esports can act as a type of hedge fund or safety blanket for clubs, against any potential future decline of football revenues compared to other forms of entertainment.”

KPMG points to similar revenue and cost structures between esports and football where the main income sources are commercial/sponsorship, broadcast and ticketing. Esports has further opportunity for digital and streaming income as well as publisher fees.

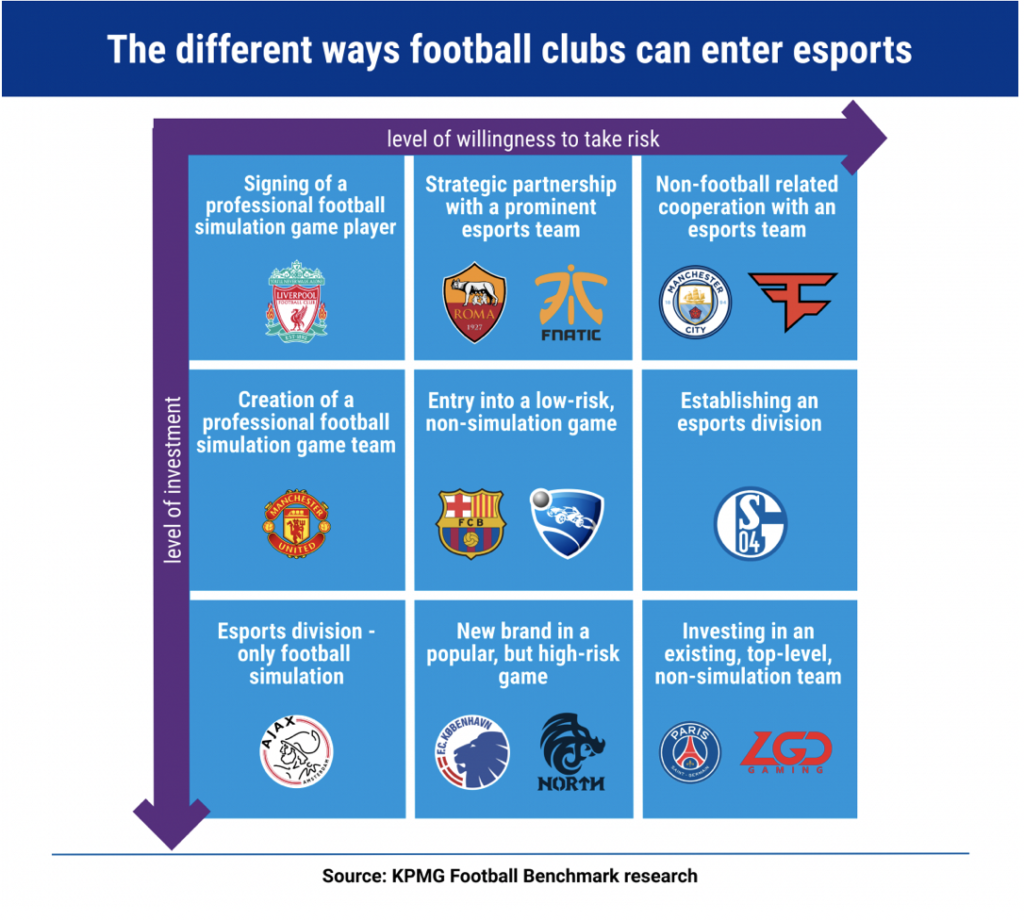

The report says that a significant number of Europe’s biggest clubs have yet to fully embrace the esports opportunity, taking a much lower risk strategy and investment strategy around football simulation games.

More gain is likely if clubs are prepared to “discover non-simulation games, or start cooperating with a dedicated, well-known esports team (such as AS Roma with Fnatic or Manchester City with Faze Clan).”

“Industry standards are already taking shape, while the new generation of fans sport the logos of brands that didn’t even exist 10-15 years ago. In any case, esports are here to stay, competing for eyeballs among a new wave of entertainment options,” concludes the report.

See the full report at https://footballbenchmark.com/library/the_digital_playing_field_football_clubs_and_esports_in_a_covid_19_world

Contact the writer of this story at moc.l1745271226labto1745271226ofdlr1745271226owedi1745271226sni@n1745271226osloh1745271226cin.l1745271226uap1745271226