April 1 – Just under 40% of the 96 teams in Europe’s Big 5 leagues are controlled by a foreign owner. The English Premier League has 16 clubs under foreign ownership, ten of them owned by US investors.

A report by the Football Benchmark team says that the attraction of owning a major team in these leagues says that the increase in non-domestic ownership has been “prompted by a variety of factors: some owners regard the clubs as prestige assets, while others seek to capitalize on the latent revenue potential of football. In today’s globalized landscape,”

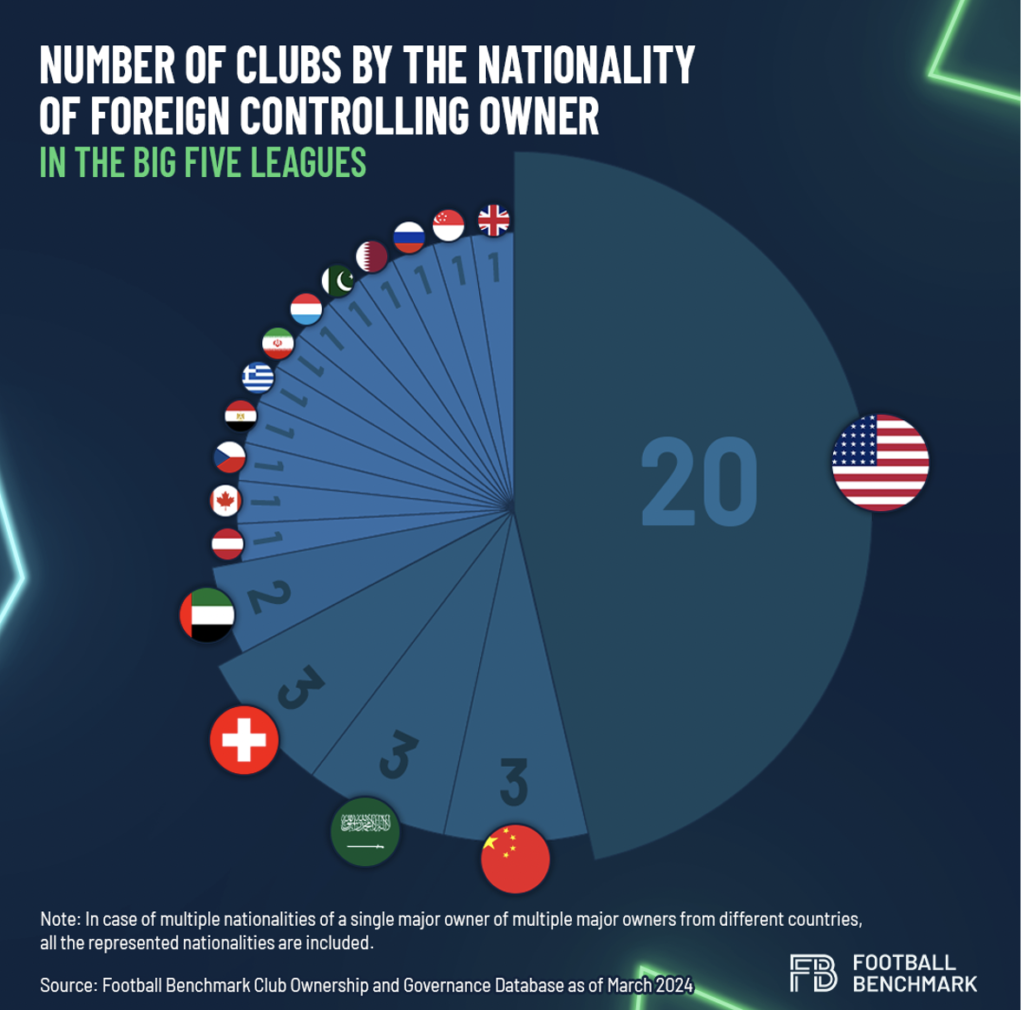

US investors lead the ownership push into the European leagues, owning 20 of the 40 clubs under non-domestic control. Chinese, Saudi Arabian and Swiss owners are the next most prevalent in ownership by nationality, with three teams owned by investors from each of the nations.

US ownership of the 10 clubs in the Premier League includes Burnley FC, AFC Bournemouth, Chelsea FC, Liverpool FC, Manchester United FC, Fulham FC, Arsenal FC, Crystal Palace FC, Aston Villa FC and Everton FC. In Ligue 1, US owners hold five clubs – RC Strasbourg, Olympique Lyonnais, Olympique de Marseille, Toulouse FC, and Le Havre FC. American ownership, overs five clubs in Serie A – Genoa CFC, Atalanta BC, AS Roma, ACF Fiorentina, and AC Milan – while only one club in LaLiga , RCD Mallorca, is American owned.

In the Bundesliga RB Leipzig is the only club controlled by a foreign owner, with its majority owner being Red Bull GmbH from Austria.

In Germany, the 50+1 rule has kept foreign and private equity at bay. The rule mandates that club members (fans) maintain ownership of more than 50% of the club, “striking a balance between facilitating private investment and safeguarding against the dominance of owners driven solely by personal interests. By preserving a democratic framework within clubs, the 50+1 rule empowers members to participate in key decisions, including the selection of board members, and provides mechanisms to effectively address mismanagement,” explains Football Benchmark.

While Germany is an outlier in terms of investment, the rest of the business world, undefined by boundaries, is alert to the opportunity of football and its affiliated industries.

“This mosaic of nationalities reflects the interconnected nature of the modern world, where capital flows freely across borders and investors seek opportunities beyond their home countries. It also highlights the growing commercialization of football, where clubs are viewed not just as sporting institutions but also as business ventures with the potential for returns on investment,” says Football Benchmark.

Contact the writer of this story at moc.l1743718644labto1743718644ofdlr1743718644owedi1743718644sni@n1743718644osloh1743718644cin.l1743718644uap1743718644