By David Owen

August 7 – Which Premier League club had the best summer transfer window in purely financial terms? By which I mean whose player trading will have the most positive direct impact on their club’s bottom-line?

This is more complicated to work out than you might imagine. It is not just a question of totting up transfer fees paid out and received and subtracting one from the other. Why? Because for accountants, players are assets and as assets, they carry a value in the accounts of the clubs they play for. Working out the likely impact of a sale on annual profits hence involves assessing the player in question’s book-value and comparing that with the fee received.

For outsiders like us, this is not a precise science, even without making any attempt to assess the effect of a club’s transfer dealings on its wage bill: fees and other details that enter the public domain are not always accurate; even when they are, extra layers of complexity such as foreign exchange rates and conditional supplementary payments can add a discretionary element; the financial year-end of some clubs falls as late as July, splitting the window – and hence perhaps the estimated totals in the table below – between two discrete reporting periods.

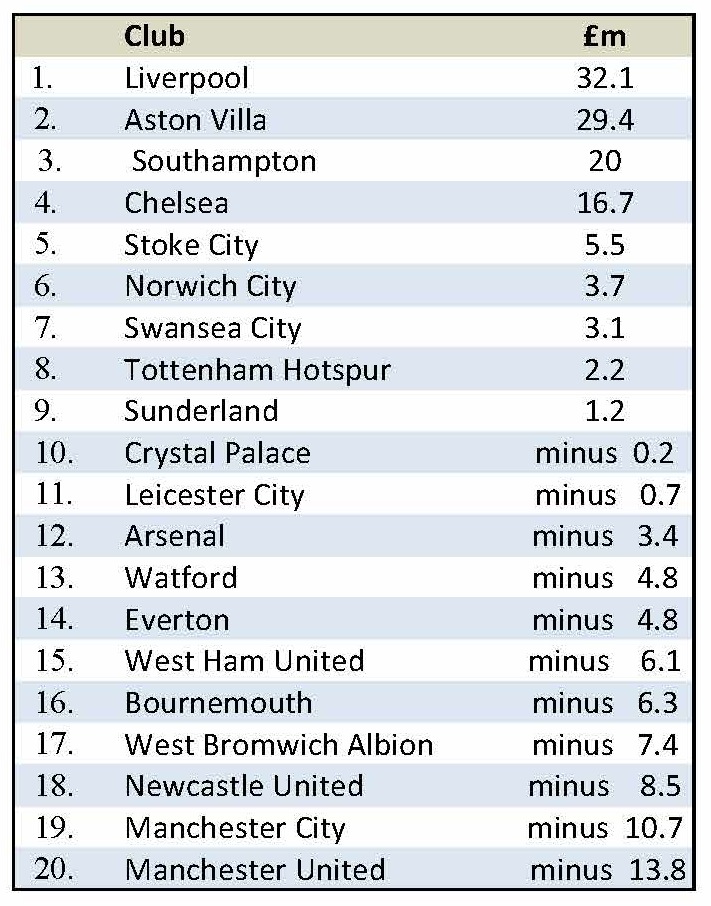

Nonetheless, I have had a stab at it – and the answer I have come up with is: Liverpool, closely followed by Aston Villa. Here is my version of the full Premier League table:

Estimated direct impact of 2015 summer transfer window dealings on annual results*:

One of the first things you might notice is that, for all the hundreds of millions of pounds spent, there are nearly as many clubs whose transfer activities look like having a positive impact on profits as a negative one. Indeed, the overall impact of player trading on profitability at all 20 clubs should be to increase profits by £45-50 million, if these estimates are close to accurate, not to cut them.

This is the magic of amortisation: when a club buys a player, it is entitled generally to amortise the fee over the length of that player’s contract. The impact of Kevin De Bruyne’s eye-popping £50 million-plus transfer on Manchester City’s results this year should thus be limited to something like £8.5 million, by my assessment.

When a club sells a player, by contrast, the full amount may be included in a single year. True, that player’s residual book-value, if any, at the time of the deal needs first to be deducted, which can result in players being sold at a loss. Nonetheless, it is above all the big-ticket sales of Raheem Sterling and Christian Benteke that account for the presence, respectively, of Liverpool and Aston Villa at the head of the table – even though both drew on the proceeds to make plenty of acquisitions.

The detail relating to a number of clubs’ summer transfer dealings is worth highlighting.

Chelsea’s window will probably be best remembered for the arrival of Pedro. Yet the club also skilfully offloaded a string of now fringe players, such as Petr Čech and Filipe Luís, for, by my estimate, more than £30 million above book-value.

Another London club, Tottenham, also shipped out a whole series of – sometimes expensively acquired – players almost always at a net profit. Etienne Capoue (£2 million), Vlad Chiricheş (£1 million), Paulinho (£1.4 million) and Lewis Holtby (£4 million) were among some eight departees who yielded, by my reckoning, more than £18 million over book-value. Only striker Roberto Soldado proved impossible to shift at a price (somewhere around the £13 million mark) that should have enabled the club to avoid a loss. Even so, I estimate that the north Londoners were able to record a modest net profit on their summer transfer dealings.

If Spurs had Soldado, Manchester United had to solve a problem called Ángel Di María. With the vast majority of the Argentinian’s reported £59.7 million transfer fee from August 2014 still to amortise, his sale less than a year later could have produced a really gaping net loss. As it turned out, the £40 million-plus believed to have been paid by Paris Saint-Germain filled most of the potential gap. I estimate that Dutch striker Robin van Persie, who was sold to Fenerbahçe, may also have left for slightly less than his residual book-value. However, I think the net profit on Jonny Evans’s move to West Bromwich Albion may well have been enough to cancel out both deficits.

The transfers of Nani, Javier Hernández and Rafael da Silva will also have yielded net profits, since the book value of all three should have been fully amortised. With the help of such disposals, the club that has dominated the Premier League era in England has been able to significantly re-engineer its squad this summer at cost of what I assess is – for it – a very modest impact on financial performance. This is in spite of the last-gasp collapse of the David de Gea deal which would very probably have lifted United into the top five of this table.

As regular readers of insideworldfootball will know, the big financial story in the Premier League in recent times has been a welcome – and widespread – improvement in profitability. This materialised in financial year 2013-14 and there seems every reason to think 2014-15 will turn out pretty well too.

Given this fundamental and, it seems, (for now) sustainable change, I wonder whether clubs who in the past would probably have offloaded coveted players at least in part for financial reasons are deciding to hang onto their stars for a little bit longer. This is one possible interpretation of the determination of Everton and West Brom to keep respectively John Stones and Saido Berahino in the face of strong interest from bigger clubs. The sale of top players can, moreover, look counter-productive in financial, as well as playing, terms if it leads to relegation – never more so than today, with the rewards of Premier League participation becoming ever more substantial.

A final note on two clubs:

First, it is possible that Bournemouth may have made a modest net profit, which I have not taken into account, on the sale of Brett Pitman to Ipswich. Second, it is reported that the fee agreed by Galatasaray for Arsenal’s Lukas Podolski is to be paid over four years. While the initial instalment is insufficient, by my calculations, to cover the German’s residual book-value, the overall sum should leave the London club with a comfortable net profit on the player.

Contact the writer of this story at moc.l1743733528labto1743733528ofdlr1743733528owedi1743733528sni@n1743733528ewo.d1743733528ivad1743733528