By David Gold

November 5 – FC Lorient President Löic Féry has called for a salary cap based on each league’s income from television revenues to prevent football from financial disaster, saying UEFA’s financial fair play initiative was a positive step, but did not go far enough.

Fearful for the future of the game in Europe without new controls to prevent excessive spending, Féry (pictured, above right) told insideworldfootball that he does not have a problem with individuals taking over a team and spending large sums on playing staff and salaries – as long as their balance books are viable.

Chelsea, Manchester City and Malaga have been taken over by billionaire owners in recent years and spent hundreds of millions in their bids for success.

Now Paris St Germain have gone down the same path, spending the best part of €100 million (£86 million/$138 million) on new players this summer.

The Parisians are threatening to dominate French football in the coming years and are top of Ligue 1 after three months of the new season.

But Féry insists their takeover by Qatari Sports Investments (QSI) has been a good thing and will continue to be, as France is one of the main markets for teams looking to buy new players.

“From the football standpoint, Paris St Germain is one of the only capital clubs in Europe which has not been present on the European scene [recently],” he says.

“For us, it was quite special, as Lorient sold [Kevin] Gameiro (pictured, above) for €15 million (£13 million/$21 million) and the first match of the league [for us] was against Paris St Germain.

“There were a lot of expectations, [Javier] Pastore [PSG’s new record signing] was presented in front of the stadium, so there was much excitement and it was sold out – and we won [1-0, with a goal from Gameiro’s replacement, Julien Quercia], and we are still the only French club to have beaten PSG [in the league].

“A lot of the money [PSG] spent was injected into the French market [they signed Gameiro, Milan Bisevac from Valenciennes, Nicolas Douchez from Rennes and Blaise Matuidi from St Etienne].

“France is one of the main buying markets, with Portugal and Holland, so if you are a club who have European ambition, you will buy in those markets.”

Another signing Féry would welcome for PSG would be that of LA Galaxy’s David Beckham (pictured, below), who appears close to agreeing a move to Paris.

“I think it is quite good for the French league if they bring a player like Beckham because what is good for the league is good for clubs,” he says.

“They may buy [Dimitar] Berbatov or Beckham, but it will benefit because money will flow to French clubs as well.”

Féry is quick to add that money does not necessarily buy success and is not of the opinion that PSG will even be the top team in France in the coming years, arguing that Olympique Lyonnais are closer to success on the European scene than the Parisians.

He is also critical of the Spanish league’s television rights model, whereby teams negotiate deals individually, rather than collectively, as is the case in France, England, Germany and Italy.

It is on the topic of finance in football that Féry comes into his element, having particular expertise in this area as the managing partner of an asset management group specialising in the income credit and debit markets.

“I think a lot of clubs are playing with fire and, especially with the economic environment getting tougher, I think football clubs have to do a better job,” he says.

By playing with fire, he means “spending more than what you have”.

“A football club is a company…the big issue is about the misalignment between revenues and charges.

“I think the move and existence of a club can only be justified if you balance, or if you de-risk, the business model. It’s difficult to do and it takes time.

“When I buy a player, I cut their salary in three or two, and if we don’t do well they only get one third of what they are looking for. If we do well, they take more than they will do previously.

“I think the way to do it fairly is to install a salary cap.”

And where would this cap be set?

“It would depend on the league, on the fixed part on the TV rights.

“Then you could have as much as you want to as long as you demonstrate all the viables you pay to players are a function of your revenues.

“We need stability, we all want the league to last, and…I don’t think UEFA’s financial fair play is concrete enough.”

The financial fair play initiative was introduced by this season and means teams have to balance their books over three-year rolling periods.

Féry’s salary cap proposal would be set at a different level for each league and, as it would be based on television rights, it would change over time, so clubs in one league would not permanently be at a disadvantage to those from another.

It also means smaller clubs can challenge the status quo, whereas, Féry points out, the financial fair play initiative will restrict smaller teams in their ability to invest large sums in trying to climb the league pyramid.

“Financial fair play will not prevent big clubs spending, it is primarily for avoiding teams which suddenly change [spending],” Féry says.

“To some extent it is done by the big clubs for the big clubs. That’s basically squeezing the relative side of the balance sheet.

“If, tomorrow, I want to inject €200 million into Lorient, I may not be able to do so. I am already aware that teams are avoiding it.”

In this, Féry sounds a bit like the Arsenal manager Arsène Wenger (pictured, above), a long-term proponent of financial fair play and a critic of what he calls “financial doping”, whereby a team suddenly spends far in excess of what they can hope to make back.

“The problem is not to prevent an owner putting money in his club,” says Féry.

“I don’t think it’s the right thing to do, but the problem is to prevent the club spending half a billion more than what their revenues are.

“If the club wants to be successful why prevent people from investing?

“The real unfair thing is to allow that some people throw a coin in the air and spend €50 million (£43 million/$69 million) more than they may make just because they think they may win the league.

“But if they end up 15th, they may end up bankrupt.”

Another thing Féry would like to see implemented across Europe are organisations such as Direction Nationale de Contrôle de Gestion (DNCG), which monitors club finances across the channel.

They examine the accounts of French teams and, if they do not comply with rules governing club finances, they can suffer a variety of reprimands, including potential relegation.

“We need more DNCG in Europe than financial fair play. I think it needs to be generalised across Europe,” Féry concludes.

But there is a caveat – he says an owner can decide to lose money if he wishes and that a balance is necessary.

“The little drawback of the DNCG is that they tend to feel they are the king of the world,” he says.

“I need to comply with the rules, but, if I want to invest, we need to find this fine line between financial rules to ensure the system doesn’t collapse.

“We need to acknowledge that each club is a specific business and can make the investment decision they like.”

Féry predicts that, without some kind of change, there will be defaults by clubs in the coming years – and, with a new financial crisis looming across Europe, this could be sooner rather than later.

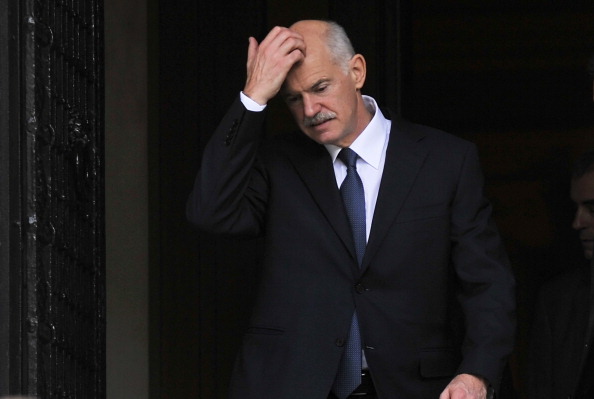

It is a sober warning as George Papandreou [the Prime Minister of Greece, pictured above] plays with fire with the Eurozone – what happens on the floor of the Greek parliament could have an impact on clubs in the biggest leagues in Europe, and, to that, no-one is immune.

Féry will speak at the International Football Arena’s 13th annual conference, in Zurich, this week, when he will join a panel of key figures from European football to discuss the continent’s top leagues.

IFA Zurich 2011 takes place on November 7 and 8 at the Dolder Grand Hotel, Zurich.

Contact the writer of this story at zib.l1745200271labto1745200271ofdlr1745200271owedi1745200271sni@d1745200271log.d1745200271ivad1745200271